does personal cash app report to irs

In order to find your Cash App account number following are the steps that you need to perform. See chapter 1 later.

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Faster ways to file your return.

. If your hobby becomes a business in the eyes of the IRS the rules change. EXECUTIVE SUMMARY THE IRS RELEASED REVENUE PROCEDURE 2000-22 and revenue procedure 2001-10 to give small businesses some much needed guidance on choosing or changing their accounting method for tax purposes. Situations covered assuming no added tax complexity.

By the due date for filing the Form 720 you must also send a separate copy of the report to the following address. If you suspect that an individual or business has been committing tax fraud you can report it to the IRS. Does binance report to irs 2021.

Stony brook hospital parking. But you do not have to report payments made to a lawyer for personal matters such as estate planning or representing you in connection with a divorce. If they dont.

Or in cash or by check or money order. As an example a Schedule E would be used by S-corporations and partnerships. The IRS wants you to declare all your hobby income even if its a small amount of money.

Doing so can help the IRS enforce tax laws. The new reporting requirement only applies to sellers of goods and services not. NW IR-6526 Washington DC 20224.

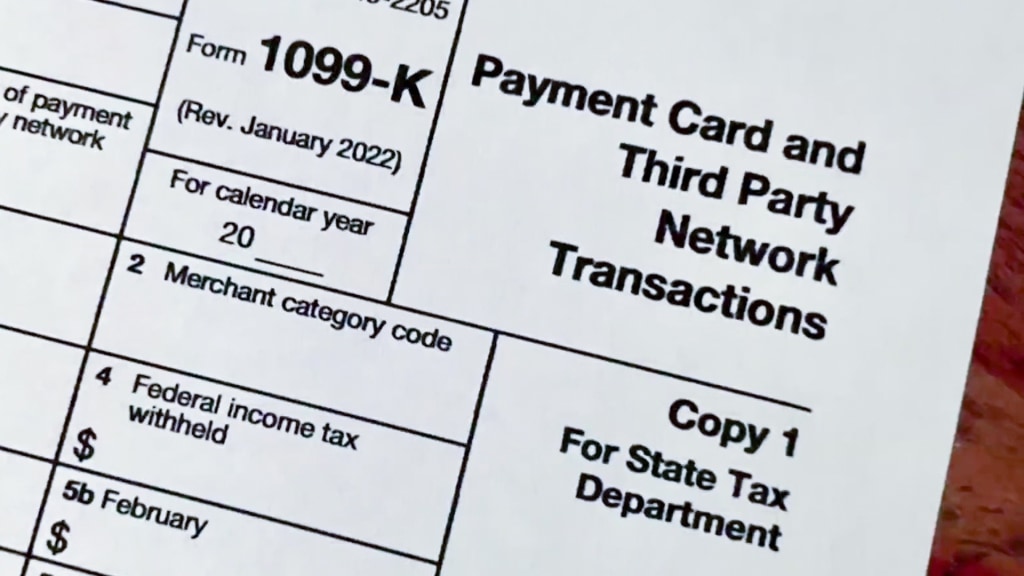

Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to report that income on their taxes. Income tax return with the IRS. Only certain taxpayers are eligible.

Membership in the Loyalty Program is free and available to any individual who. Paying electronically is quick easy and faster than mailing in a check or money order. Therefore the amount of your charitable contribution for the land would be its fair market value of 28000.

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. The IRS fraud hotline is one tool to help Americans give the agency information about suspected tax cheating. As of Jan.

While the typical loan is a mortgage a home equity loan line of credit or second mortgage may also qualifyYou can also use the mortgage interest deduction after refinancing your homeJust make sure the loan meets the. We give anonymity and confidentiality a first priority when it comes to dealing with clients personal information. From a mobile device using the IRS2Go app.

All our clients personal information is stored safely. We have encrypted all our databases. Instead just wrap it in ads.

Keeping Records of Cash App Transactions. And you may even be eligible for a cash reward in some cases. D provides valid.

B resides in a jurisdiction which legally permits participation in the Loyalty Program. The report must contain all information needed to complete the model. A model first taxpayers report is shown in the Appendix as Model Certificate B.

Almost all the verified customers of CashApp have their account numbers that is assigned to them. Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Department of the Treasury Internal Revenue Service Cincinnati OH 45999-0555.

If you have specified foreign financial assets in foreign jurisdictions valued above certain threshold dollar amounts you may have to file Form 8938 when you file your US. Cash App can be utilized for a number of its features but to avail any type of Cash App services you should have Cash App account number. An award isnt an item of tangible personal property if it is an award of cash cash equivalents gift cards gift coupons or gift certificates other than arrangements.

A possesses the legal authority to agree to the Program Rules. The following are some of the ways we employ to ensure customer confidentiality. You also gave 5000 cash to a private nonoperating foundation to which the 30 limit applies.

To track your refund go to IRSgovRefunds or download the IRS2Go mobile app. These include a home loan to buy build or improve your home. C is not a resident of Crimea Cuba Donetsk Peoples Republic Iran Luhansk Peoples Republic North Korea and Syria.

Identity Thieves Earn Cyber Cash Stick Victims With Tax Bill Imagine getting a bunch of tax documents telling you and the IRS about a large sum of money you made when in fact you never received. There are a few types of home loans that qualify for the mortgage interest tax deduction. Search engine marketing SEM is a form of Internet marketing that involves the promotion of websites by increasing their visibility in search engine results pages SERPs primarily through paid advertising.

1 mobile payment apps like Venmo PayPal Zelle and Cash App are required to report commercial transactions totaling more than 600 a year to the IRS. Check out the IRS Small Business and Self-Employed Tax Center if you find that your hobby has turned into a business. In most cases you will report this income on a Schedule C filed with Form 1040.

The forms used may differ based on your business structure. Form 8938 Statement of Specified Foreign Financial Assets. You can pay your taxes by making electronic payments online.

To report suspected human trafficking call the DHS domestic 24-hour toll-free number at 866-DHS-2-ICE 866-347-2423 or 802-872-6199 non-toll-free international. Indeed the Internal Revenue Service IRS matches nearly all 1099s and W-2 forms the wage-report forms from your employer against your Form 1040 tax returns or other tax forms. How to use your car to earn cash without driving for a living You dont have to work for Uber or Lyft to make money using your car.

PayPal and Cash App to report The new reporting requirement will ensure that small businesses that receive payments through. You must declare hobby income. The 2000 cash donated to the church is considered first and is fully deductible.

W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. We have servers that operate 999 of the time. SEM may incorporate search engine optimization SEO which adjusts or rewrites website content and site architecture to achieve a higher ranking in search engine.

We welcome your comments about this publication and suggestions for future editions. It is vital that you keep accurate records of cash app transactions. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle Cash App or Venmo.

REVENUE PROCEDURE 2000-22 ALLOWS ANY COMPANY sole proprietorship partnership S or C corporationthat meets the sales. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Tax Changes Coming For Cash App Transactions

Cash App Income Is Taxable Irs Changes Rules In 2022 Chosen Payments

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

How Does The Irs Law Work On 600 Payments Through Apps Marca

Changes To Cash App Reporting Threshold Paypal Venmo More

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Changes To Cash App Reporting Threshold Paypal Venmo More

How Does The Irs Law Work On 600 Payments Through Apps Marca

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Irs Has New Ways Of Taxing Cash App Transactions

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Earning Money Through Paypal Or Venmo You May Owe The Irs Money Next Year Cnet

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

The Irs Is Cracking Down On Digital Payments Here S What It Means For You Cnn Business

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com